Forex Currency

All countries use currency, and those currencies are used by Forex trading brokers in the Forex market. The Forex market has no central marketplace location for foreign exchange of currencies.

The trading system that the Forex exchange online uses occurs through a global computer networking system that traders from around the world partake in, eliminating the use of a centralized exchange system. However, there are countries with currency that is traded more than other countries due to their economic strength. These currencies include:

- The American dollar (USD)

- The Great British pound (GBP)

- The Euro (EUR)

- The Canadian dollar (CAD)

- The Australian dollar (AUD)

Although the most traded currencies are not all equal in value to one another, some are relatively close. Like bonds and stocks, Forex markets also utilize bids and offer/ask prices. Buyers will place a bid with a set price that they deem fit for the asset they are bidding on. The offer/ask price is the set price the seller is willing to sell the asset for. The ask price is what the buyer can negotiate with.

Are you thinking you may try Forex exchange online? When you start trading currencies, you’ll find there is an exchange rate to swap one currency to another. For example, if one is from the United States and is dealing with a broker from Australia, one AUD is worth .69 USD. Exchange rates are important to note when looking to trade or invest in currencies. Knowing these values can give one better ideas on a gameplan they’d like to execute when online trading.

Forex Trading

Forex trading is very similar to trading stocks and equity. However, Forex trading is unique. It’s important to learn about all aspects that comprise Forex trading. Beginners may find that it’s best to set up a smaller Forex trading account with low requirements. Trial experiences allow beginners to try trading with a small trading account. This can help the trader become more comfortable with trading, and give them more time and allow them to figure out their investment style.

Developing a trading strategy helps a trader set up an identity they can rely on. While it is not always possible to anticipate movements in the market (or changes in value of assets), having a style can help guide a trader in the direction that suits them best. The best strategies are based around knowledge and understanding current market conditions. Doing this will always give the trader the best chance to react to circumstances, allowing them to get ahead of the curve to produce even better results.

One of the most important steps in becoming a successful Forex trader is to check the position of your portfolio by the end of each day. Many trading softwares already provide a chart to view the trajectory of your trades. These charts allow you to see how you fared that day. It’s important for the trader to view and analyze these numbers regularly, as they will give insight on future trading decisions.

Always be sure to have sufficient funds available before trading. Carefully map out trade plans in advance and stick to your budget. This will prevent you from spending more than you meant to.

Making a Profit in Forex Trading

To make money by working with Forex trading brokers, prepare accordingly. Forex traders need to assess how much risk they are willing to take, as well as how much time and effort can be dedicated into the trading process. Due to the volatility of the everyday market and how quickly things can change, short term strategies can be a profitable option.

Following and analyzing market trends is a fantastic way to find an asset to focus on. Analyzing the market charts on Forex can also help the trader determine when to exit a trade or when to double up. This strategy helps the trader minimize losses and maximize profits and gains. If you’re not sure where to start, Forex trading brokers can offer great tips.

Long-term strategies are a good method when it comes to online trading. The trader will notice greater trends and fluctuations when implementing a long term strategy. This way, traders can make more profitable decisions. Forex trading brokers can offer their experience due to the long term of their dealing.

The Liquidity

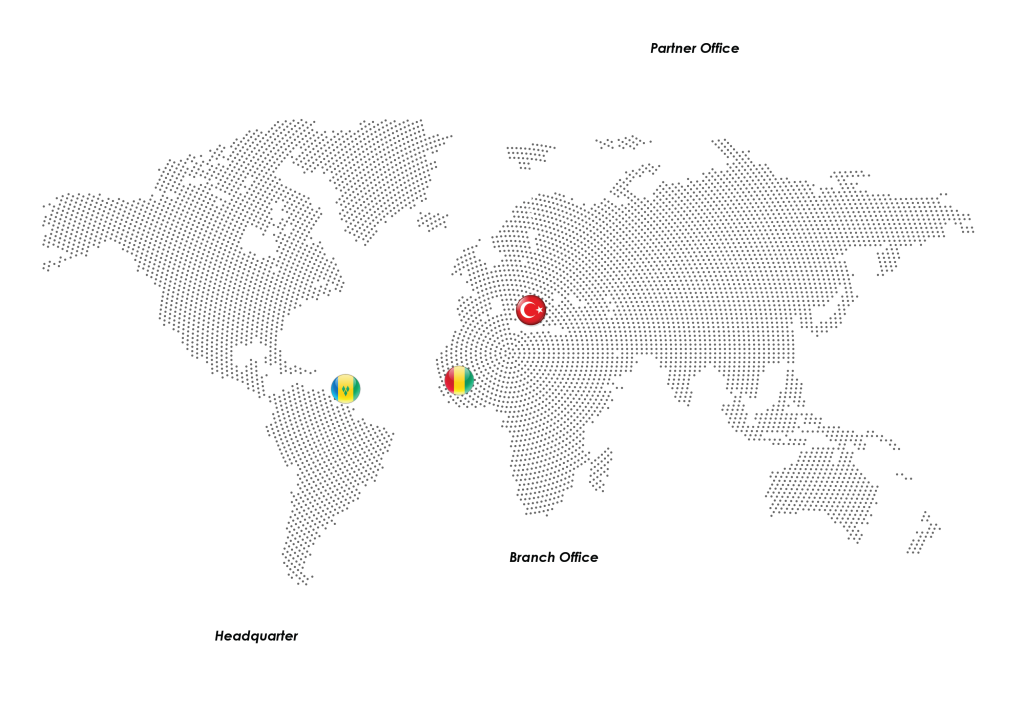

At The Liquidity—a leading financial institution offering Forex investment services to more than a million clients worldwide—we provide award winning service and guidance to limit distractions and help focus on what really matters, making profit. Every year we improve our standards in an ongoing effort to make trading with us a great experience.

For more information on how we can help you achieve your dream portfolio, contact us where you can chat with live chat chat support, or request a call back for instant help from our support team. Feel free to also email us at cst@theliquidity.com for any other inquiries or questions.

Legal: Liquidity Ltd is incorporated in St. Vincent & the Grenadines as an International Business Company with the registration number 24896 IBC. The objects of the Company are all subject matters not forbidden by International Business Companies (Amendment and Consolidation) Act, Chapter 149 of the Revised Laws of Saint Vincent and Grenadines, 2009, in particular but not exclusively all commercial, financial, lending, borrowing, trading, service activities and the participation in other enterprises as well as to provide brokerage, training and managed account services in currencies, commodities, indexes, CFDs and leveraged financial instruments.