How Leverage Works

Leverage in CFD trading refers to borrowing capital and looking to increase potential return on an investment with it. This is mainly done by guessing the movement of prices and looking to make max returns on it. One of the main benefits of having CFD investments is the ability to gain securities on margins. Instead of having to pay for full value of the contracts, an investor or trader can enter a position with low margins, giving access to more exposure than what is typically found in securities that are not leveraged.

It’s important to note that in order to access this, a small fee is required to open the initial trade. The trader will still be exposed to the price movement of the shared CFD. Trading a CFD at 20% margin is the same as leveraging the exposure by 20 times. A $20,000 deposit allows for a potential position to open to $200,000.

A small fluctuation in the current value of the asset can lead to gigantic returns and gains, as well as similar losses. Depending on the movement of the asset and its value on the market, there can be a lot of fluctuation.

One of the most important things to do before CFD trading is taking the time to research. It’s wise to gather extensive knowledge and understanding on the variables that come with CFDs. Combining this with knowledge of the leverage effects they offer will put you in a much better position.

Leveraging your capital gains can be a success or failure depending on the amount of understanding on CFDs the trader has, so this understanding is crucial. At the end of the day, CFDs are essentially a bet that is leveraged on market fluctuations and asset value changes.

Effects Of Leverage

The research needed to learn about the effects of leverage and how they can work for or against the trader is similar to the research needed before purchasing a home. At times, it can be difficult to find a buyer for a home unless the value begins to decline. With CFD investing, the amount lost from the value of the asset is in direct control of the trader. The reason for this is that a trader can choose the moment to sell at any time. They will always be able to sell, unlike someone who is trying to sell a home or property and doesn’t know if they will succeed.

A trader may also decide that this risk is one they are willing to take. If it is, they may continue to hold the asset. Alternatively, a trader may decide a risk is not worth it and choose to sell immediately. The effects of leverage—and what entails leverage—can be summarized as follows:

High risk and high reward

Higher knowledge of CFDs increases chance of success

Ability to control leverage which helps to minimize loss/maximize gain

Ability to sell or purchase CFD assets at any time

It’s important to note that there is a level of high risk when it comes to CFD trading, but with this risk comes high reward. The more knowledge one has, the better one will fare.

Risks That Come With Leveraging

Leveraging CFDs definitely comes with risks. One risk is a decrease in the price of a dividend. Due to the volatility of the markets at some times, an asset may decrease in margin value. This affects the leverage and lowers the maximum yield potential.

Another risk of leveraging comes down to the central banking systems. At any time, a bank can raise their base interest rates. This can lead to a direct increase in finance charges for CFD assets. For better or worse, this will affect the marginal difference as well as the dividend yield. This can lead to a less effective overall gameplan.

Sometimes you may experience a change in the margin of requirements. A lower leverage ratio will have a higher margin requirement compared to a lower leverage ratio, which will have a higher margin requirement. This can impact the capital made during CFD investing and trading.

CFD Investing Overview

To sum it up, CFD investing is geared towards those who have a tolerance and desire to participate in high risk trading, and are interested in exploring new ways to expand their gains and portfolio worth.

CFD investments can be a great option in doing so due to the trader only needing to put up a fraction of the full asset value to be able to input a trade. This is great for those with less capital and are looking to increase their portfolio value.

The Liquidity

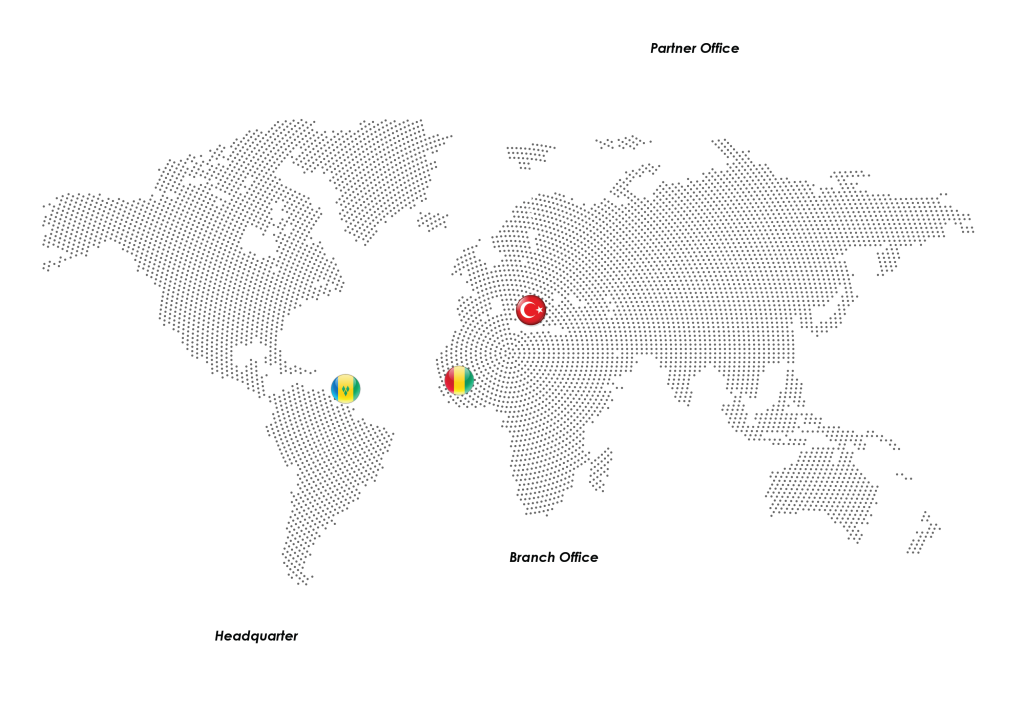

Here at The Liquidity—a leading financial institution offering CFD investment services to more than a million clients worldwide—we want to provide you with top-notch access to the financial markets. We strive to do this via our ultra-low latency trading infrastructure.

Offering a first class broker experience and an award winning order execution with excellence service and guidance, we want to make sure you reach your mission. For more information on how we can help you expand your finance portfolio, visit our website.

Legal: Liquidity Ltd is incorporated in St. Vincent & the Grenadines as an International Business Company with the registration number 24896 IBC. The objects of the Company are all subject matters not forbidden by International Business Companies (Amendment and Consolidation) Act, Chapter 149 of the Revised Laws of Saint Vincent and Grenadines, 2009, in particular but not exclusively all commercial, financial, lending, borrowing, trading, service activities and the participation in other enterprises as well as to provide brokerage, training and managed account services in currencies, commodities, indexes, CFDs and leveraged financial instruments.