How CFDs Work

A contract for differences (CFD) is essentially an agreement between an investor and broker. It is an advanced trading strategy that is mostly done by experienced traders only. Since CFD trading is all done online, there is no trade of physical goods with CFDs. When looking to invest, you can place bets using CFD. A CFD involves two trades: the first creating the opening position while the second trade closes it out. The bet is geared towards whether or not an underlying asset will increase or decrease. Traders can bet on either trajectory.

If a trader who has purchased the CFD has bet on an asset that has increased in value, they can look to offer their holding for sale and make profit on that margin. The net value of the difference and the sale price are combined together. On the other hand, if the broker believes that there will be a decrease in the trader’s asset, an offer can also be made by the broker to obtain the trader’s asset. CFD investing offers dynamic trades. This allows either party to make a move and capitalize on changes of an assets value.

Benefits of CFDs

There are many benefits of CFD trading. These benefits may include:

Higher Leverage

CFD trading simply provides more leverage than traditional trading strategies. The margins are much lower and result in less capital outlay for the trader. This directly results in larger potential returns for the trader.

Global Market

Due to CFDs existing in the market of online trading, the market is available on a global scale. This allows for almost nonstop trading and activity on the market. Traders arrive from around the world, trading while in different timezones.

No Requirements

In the day trading world, a trader must meet certain market requirements before they can trade freely. While there is a limit to the amount of day trades one can make, there is no such restriction within the CFD market.

Variety of Trading Options

Brokers offer trades in multiple different CFD options. This allows them to choose from a variety of top level exchanges.

No Shorting

One of the greatest variables of dealing in CFDs is that shorting is prohibited. This also means no stops or limits. Since the trader does not own the underlying asset, a shorting cannot be implemented at any time without borrowing costs.

These are some of the reasons why CFD trading is a great option to dive into. With no shorting and the benefit of a global market to engage in, it doesn’t take long to get involved in this world of online trading.

CFD Regulations and Warnings

It’s important to read the CFD regulations in the country of residence, as it’s illegal in some countries. CFD contracts are prohibited in the United States, United Kingdom, Germany, Switzerland, Singapore, Hong Kong, Thailand, and a few other nations in western Europe.

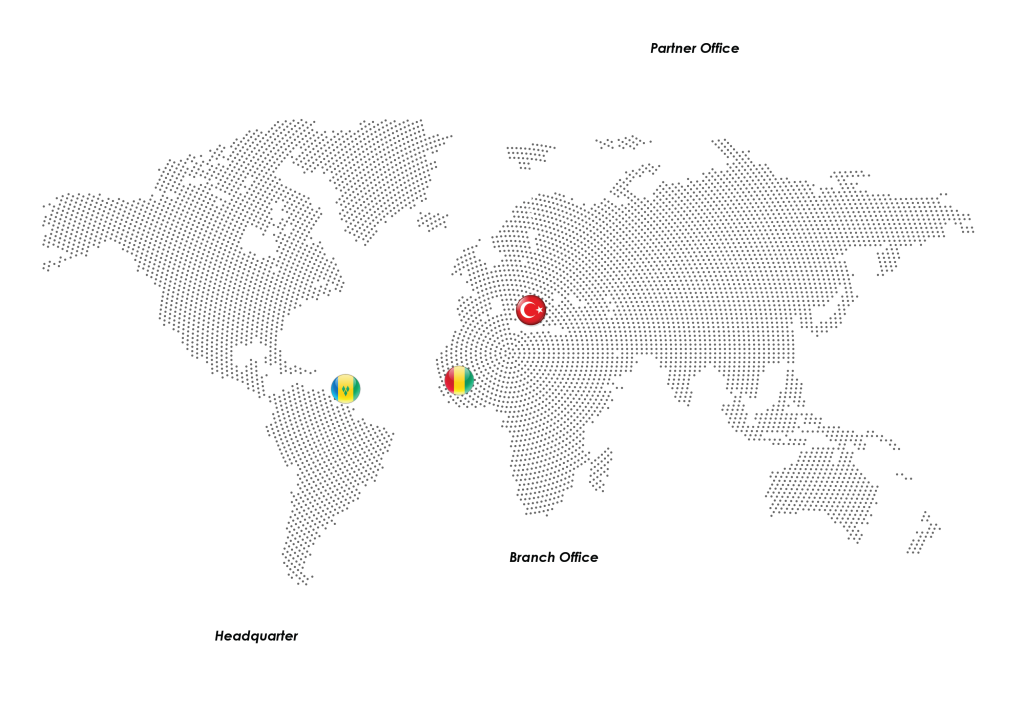

Legal Disclaimer: Liquidity Ltd is incorporated in St. Vincent & the Grenadines as an International Business Company with the registration number 24896 IBC. The objects of the Company are all subject matters not forbidden by International Business Companies (Amendment and Consolidation) Act, Chapter 149 of the Revised Laws of Saint Vincent and Grenadines, 2009, in particular but not exclusively all commercial, financial, lending, borrowing, trading, service activities and the participation in other enterprises as well as to provide brokerage, training and managed account services in currencies, commodities, indexes, CFDs and leveraged financial instruments.

Risk Warning: Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary seek independent advice. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading on margin. The Liquidity does not accept clients from the U.S., Canada, Iraq, Sudan, Syria and North Korea. The Liquidity provides general advice: The Liquidity provides general advice that does not take into account your objectives, financial situation or needs. The content of this Website must not be construed as personal advice. The Liquidity recommends you seek advice from a separate financial advisor.

The Liquidity

At The Liquidity, we want to help you explore the world of online trading with CDFs on thousands of different products. We provide high quality access to global financial markets through our next gen infrastructure. Come trade with a first class broker like The Liquidity, who can provide award-winning execution and service. For more information on what we can do to start your CFD trading profile, visit our website.